Gallery traffic in 4 months: a snapshot of EU↔US↔Mexico art fairs

Provides comparative data on the presence of galleries at fairs between these territories. Should tariffs increase, this could accelerate the regionalization of art fairs.

Before the 90-day moratorium on trade tariffs expires, 220 galleries from the EU, the US, and Mexico will have attended 30 art fairs in these regions by the end of April.

Even though major fairs are still to come -including high-profile events like Art Basel Miami, The Armory Show, Frieze New York, and Artissima Turin (the latter still accepting applications)- it’s already possible to analyze the comparative impact of the art fair business in terms of gallery movement between these three regions.

Based on available data, if the 220 galleries were to participate in these fairs again and no trade agreement is reached between the US and the EU and Mexico, all of them could face additional costs (on top of already steep expenses) due to increased tariffs: 29% for artwork shipments between the EU and the US, and 25% for those from Mexico. For now, Latin America remains unaffected at 10% (see the article on Aurora and Athena).

What can we take away from these art fair participation numbers in the first four months of the year?

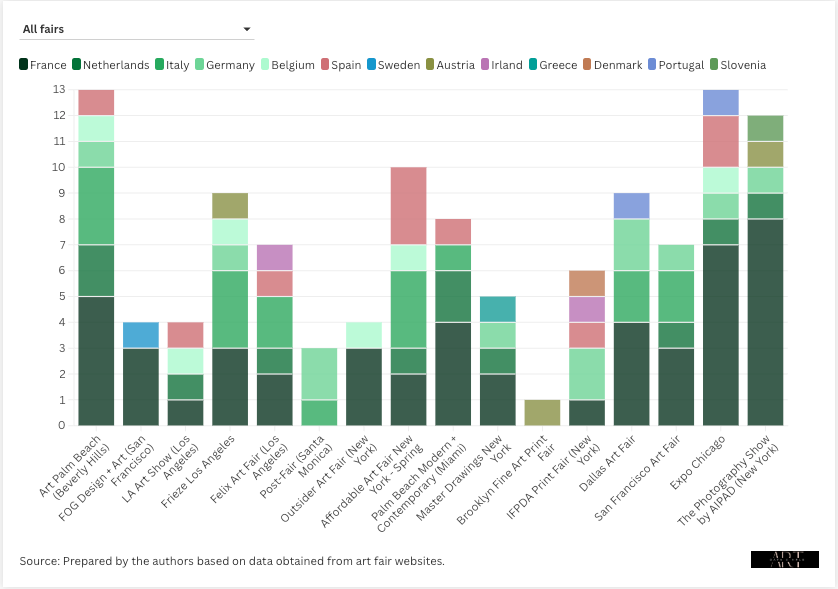

If we look at the number of galleries from 13 European Union countries taking part in 16 US art fairs, the figure reaches 115.

Of all these countries, France stands out, with 48 galleries participating in 14 of the 16 fairs. Its strongest presence is at the AIPAD Photography Show and Expo Chicago, featuring 8 and 7 galleries, respectively.

On the other hand, if we examine U.S. galleries’ participation in 7 of the 12 fairs held in the EU, the total reaches 44, with 28 of them showing at TEFAF Maastricht alone. This suggests that galleries specializing in antique and modern art have a greater international reach compared to those focusing on contemporary art. As the data visualization below reveals, contemporary galleries either skip major fairs like Art Rotterdam and Art Paris or maintain a minimal presence (just two galleries) in strong eurozone markets such as Art Düsseldorf.

Meanwhile, Mexican galleries have had a modest presence, with only 10 participating (mainly from Mexico City) in 6 of the 16 U.S. fairs.

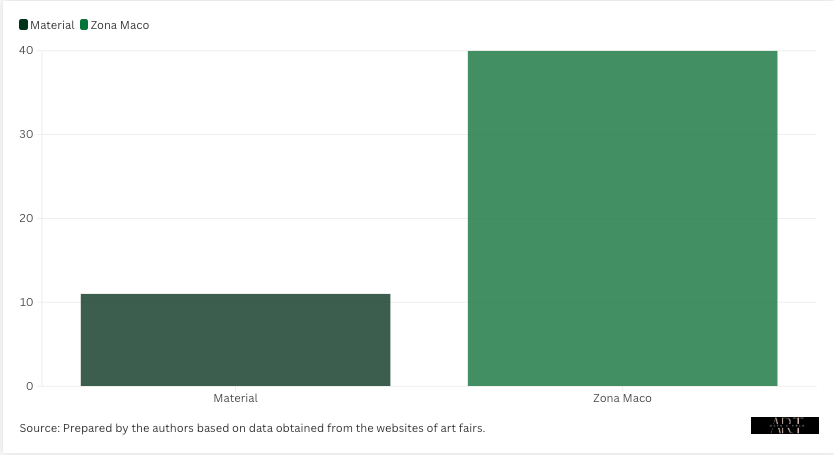

By contrast, 51 U.S. galleries exhibited at just 2 Mexican fairs, with 40 appearing at Zona Maco, Mexico's premier art fair.

Not only do more EU galleries travel to U.S. fairs than vice versa, but they also participate at higher rates across nearly all events, as the accompanying data visualization demonstrates. One notable case is Master Drawings New York, where European galleries account for 19.2% of participants.

The potential impact is clear: American art fairs would likely bear the brunt of any disruption, forcing European galleries, particularly those in France, to conduct more rigorous cost-benefit analyses about transatlantic participation.

What emerges from the data is that U.S. fairs already maintain strong domestic foundations, with 60% to 95% of exhibitors being local galleries. Europe shows a parallel self-sufficiency, with minimal dependence on U.S. gallery participation. Should tariffs increase, this could accelerate the regionalization of art fairs in both markets.

A comprehensive assessment of specific fair-by-fair or country-specific impacts, including effects on dual-location galleries like Kurimanzutto (with spaces in both Mexico City and New York), would require more targeted research beyond the scope of this analysis.

Mexico presents a paradox: While Mexican galleries show minimal presence at U.S. fairs (averaging just 0.81% participation), American galleries account for a substantial 30% of exhibitors at Zona Maco. This imbalance would leave Mexico particularly exposed if new tariffs take effect, more vulnerable than other nations in the current trade landscape.

According to the latest Art Basel & UBS report, art fairs account for 31% of total gallery sales, still below the pre-pandemic peak of 42% in 2019, when they briefly surpassed gallery transactions. Should trade tensions escalate between the UE↔USA↔México, the repercussions would extend far beyond added costs: the entire art ecosystem could face unpredictable disruptions with cascading effects for art fairs and galleries.