The return of Ibero-American galleries as an indicator for future applicants to Frieze, Tefaf, and Independent

Recent history suggests that return is a good indicator, especially for gallery owners considering applying to one of these fairs for the first time.

Most media outlets and press releases report large audiences, million-dollar sales, and a vibrant atmosphere for the recently closed Frieze, Tefaf, and Independent in New York. However, beyond this information, which sometimes needs to be taken with a grain of salt, it's difficult to know whether the 18 Ibero-American galleries that participated in these fairs truly lived up to expectations.

Since we can't yet tell which ones will return in 2026, analyzing their return history over the last five editions (2021-2025) is a good indicator.

The pattern is clear: those that return tend to have positive results; those that didn't probably didn't meet expectations.

And if we review participation since 2021, we find data that, while not definitive, helps us gauge whether the fairs have truly been profitable in four ways highly valued by gallery owners:

Collector feedback

New professional contacts

Cost-benefit ratio

Organizational performance

While we await the official list of participants for 2026, recent history suggests that return is a good indicator of real success, especially for gallery owners considering applying to one of these three fairs for the first time.

Because it's clear to everyone that participating in fairs is a hugely important decision for gallery businesses, accounting for 31% of total sales, according to the latest report from ArtBasel & UBS.

Which fair is leading the way?

As you can see in the following two visuals, Frieze, which just announced a new owner, has garnered the most returns and participation.

Suppose we look at the percentage of returns. In that case, they are disputed between Frieze and Tefaf, since Independent, in addition to being a fair with a high turnover of galleries, has had a very low or non-existent presence of Ibero-American galleries, something that also happens to Tefaf, however, in its case, it has had more loyal galleries.

Who are the seven galleries with the most returns to Frieze?

Leading the way is Brazilian Mendes Wood DM, which has had a space in New York's Tribeca neighborhood since 2022. According to Artsy, the gallery sold Sliced Stones (2018), an installation of eight sculptures by Kishio Suga, to an institution for between $200,000 and $300,000.

With four more, we find other galleries based in New York, such as Mexico's Kurimanzutto and Colombia's Instituto de Visión.

In their cases, as they have launched into the New York market, opening spaces, the variable of prestige should be introduced and considered here, even more than the rest, when it comes to returning.

Rounding out the Top 7 is Brazilian Mitre, which, incidentally, won the award for best stand in the Focus section thanks to a single project by artist Luana Vitra.

And in the Top 3 returns to Tefaf?

Nara Roesler, another Brazilian based in New York, sold a Tomie Ohtake oil painting for $350,000, according to the aforementioned media.

Spanish gallery Mayoral has made the same number of returns in the last five years. After participating in three consecutive editions, she did not attend this year's edition. However, this year, she participated in Tefaf Maastricht and Art Basel Hong Kong and will do so at the next Art Basel.

And third place goes to the also Brazilian Gomide&Co.

Where do the most loyal galleries come from?

By now, you'll have guessed that, over the five-year period, Brazil has the most galleries, with 33, led by Frieze and Tefaf. Mexico is a distant second with 9, and the leader at Independent, where the Curro gallery is making its second consecutive appearance.

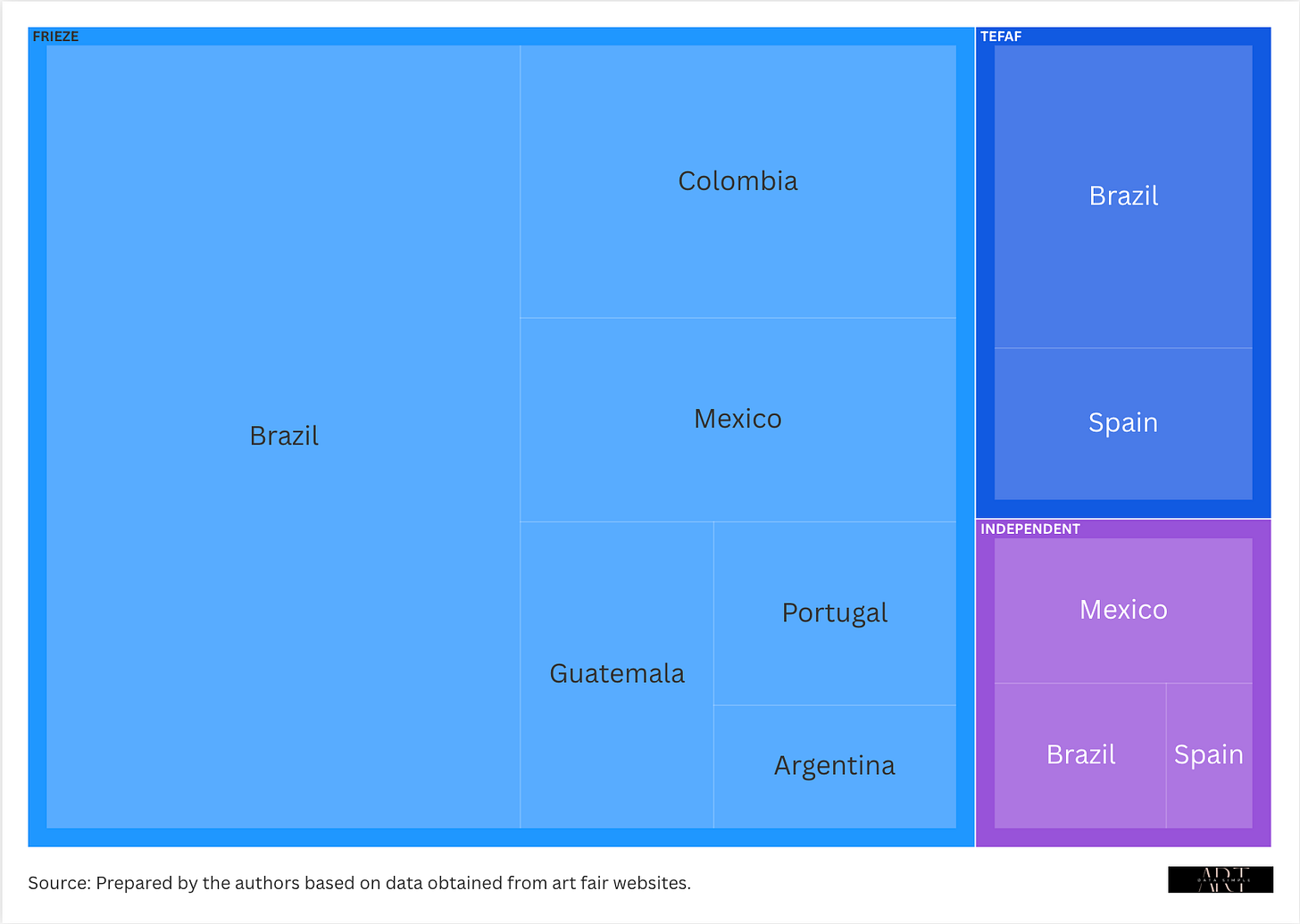

In the following visual, we break it down even further.

At which fair is the percentage of Ibero-American galleries growing?

Again, it's Frieze, where it has increased over the last three editions. By 2025, it represented 20% of the total galleries.

In the absence of a DeLorean to travel to the future, analyzing the return of galleries in the last five editions (since the pandemic halt) offers revealing clues for gallery owners considering applying to these fairs for the first time.